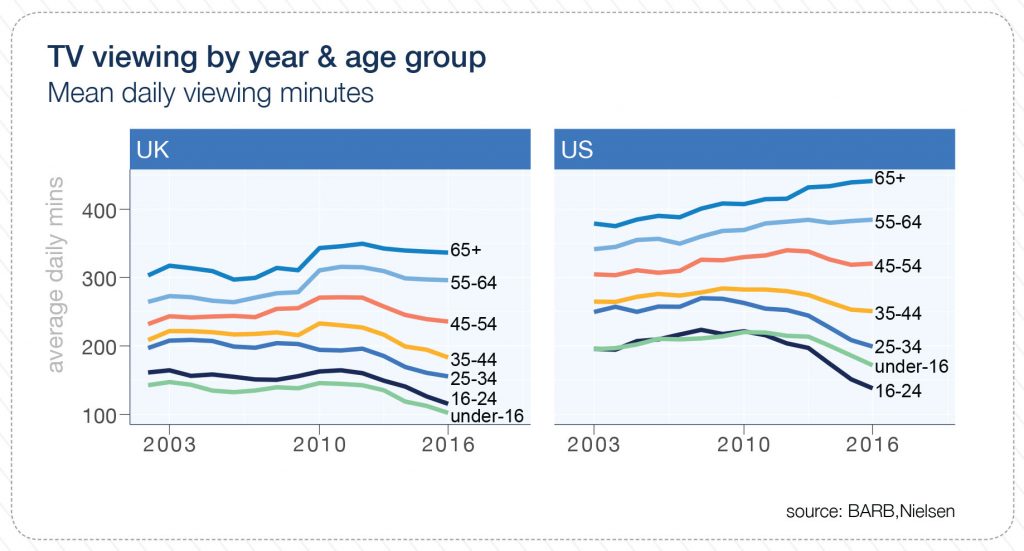

Sixteen to twenty-four year olds are TV’s scarcest age group. The loss of younger viewers is a serious problem for TV’s future. According to ‘The State of Video Report’, authored by GroupM’s Global Chief Digital Officer, Rob Norman and Futures Director, Adam Smith, millennials will never take to traditional television.

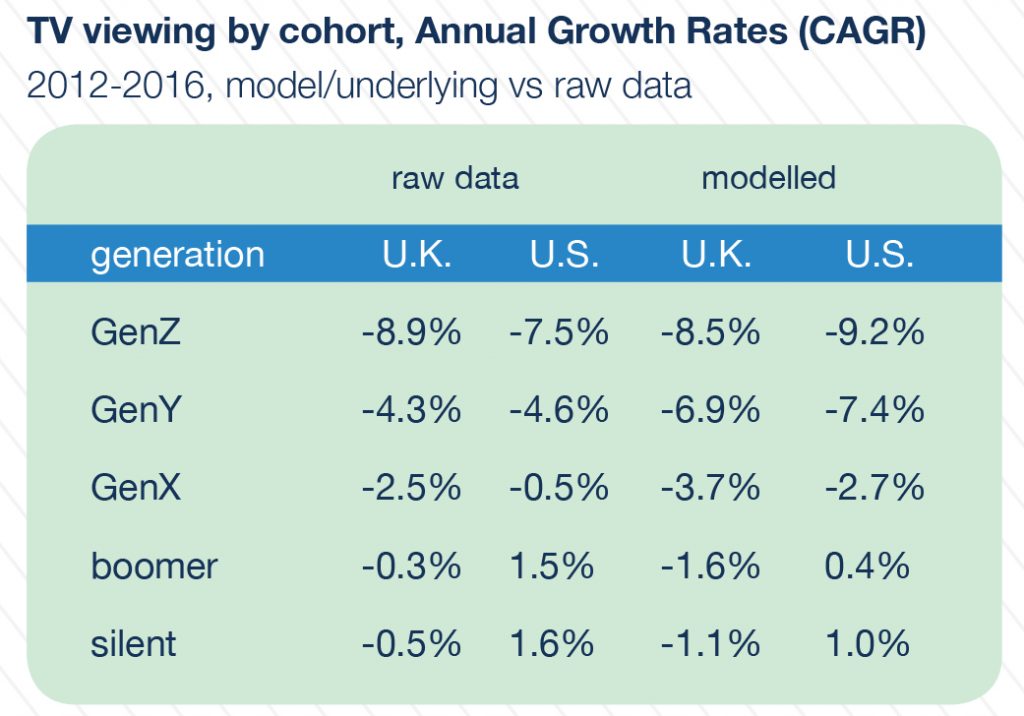

While total video consumption across all formats has likely grown, traditional TV viewing in US and UK, by GenY has fallen about 4.5% annually since 2012.

Growing older does not increase one’s TV viewing consumption, like it used to. On an average, this category watches less than 200 minutes of TV daily in the UK and less than 250 minutes in the US. This is lower than any other age group.

The report states that GenY and GenZ are watching less TV as they age and the viewership is falling 60% faster than the historical norm. None of these benefit the original advertisers who helped build the television economy. According to the report, audiences are, now, becoming intolerant of long commercial breaks. The theory is that, better advertising, more native to its environment, will retain audiences better and improve recall further. TV needs to make advertising relevant to the consumer.

Addressable TV Is Growing

The report suggests that addressability serves advertising better. Advertisers must embrace the evolution to addressable and on-demand, and use data and targeting to compensate for declines in reach. Addressable advertising picks out people, not programs. As a result, the value of an audience to an advertiser is less about reach and frequency, but about targeting the right audience. Addressable TV allows networks to insert ads into linear and time-shifted TV ad breaks which are seen only in homes selected by criteria of location, income, demography, purchasing behaviours and so on. When executed properly, this presents advertisers with a premium platform for reaching audiences in broadcast-quality content across a brand-safe, live and on-demand environment. Currently, addressable TV is only available at scale in the US via pay TV providers. The total number of addressable US TV households (linear plus VOD) is estimated to stand at 68 million, up from 50 million in 2016.

Challengers To TV’s Video Advertising Crown

The report further states that advertisers must explore new forms of content and new channels. Group M regards TV’s biggest challengers to be YouTube, Facebook, Amazon, Twitter and Snapchat.

According to the report, the viewership of YouTube on TV (screens) grew 90% in the US in 2016 and is set to grow 90% in 2017. This could be due to the rise of more professional quality content. However, YouTube is still not regarded as a replacement of TV for advertisers. The report states that YouTube still lacks sufficient inventory that the advertiser would describe as quality.

When it comes to Facebook, it defines video as any moving image: “from a GIF to a slideshow to conventional video.” This may point to ways for advertisers to use Facebook video quite unlike television. Advertisers could animate all images, rather than aim to compete solely on short video clips. Currently, the only challenge when it comes to advertising on Facebook is the issue with autoplay (as opposed to user-initiated), and with data. Recent moves at Facebook suggest that it aims to capture more of the “traditional” video advertising formats. Facebook Live opened to all users in April 2016 to increase engagement on the platform. The report implies that it is highly likely that Facebook will have a video product that launches from the newsfeed but is a linear viewing experience, a much more TV like advertising experience. Facebook’s push into original content could propel its conquest of TV advertising.

Amazon is moving ever more aggressively into original programming. It is estimated that Amazon and Netflix together spend $10 billion per year on content creation and acquisition. Amazon’s move from on-demand only to live linear OTT and live streaming has attracted much attention. The report suggests that in time to come, Amazon will become a direct competitor to YouTube.

From an advertiser’s perspective, Twitter’s live video and products are among the most attractive of the in-feed options. Ads score high on viewability and completion metrics. The report states that approximately half of Twitter’s $2bn revenue comes from video. Twitter’s main constraint is, however, the time spent on platform. Monetisable time spent is the key to economic success for advertising on Twitter.

Today, the total number of Snapchat users globally is twice the US number of around 68 million. From a placement perspective, the authors of the report explain that the Snapchat video is highly attractive to advertisers, which appear in interstitial format thus eliminating “shared screen” issues and some brand safety risk. The video format is equally attractive as it is optimized only for the phone. There is a full screen format, vertical video with a 10 second maximum view time and the option to see more.

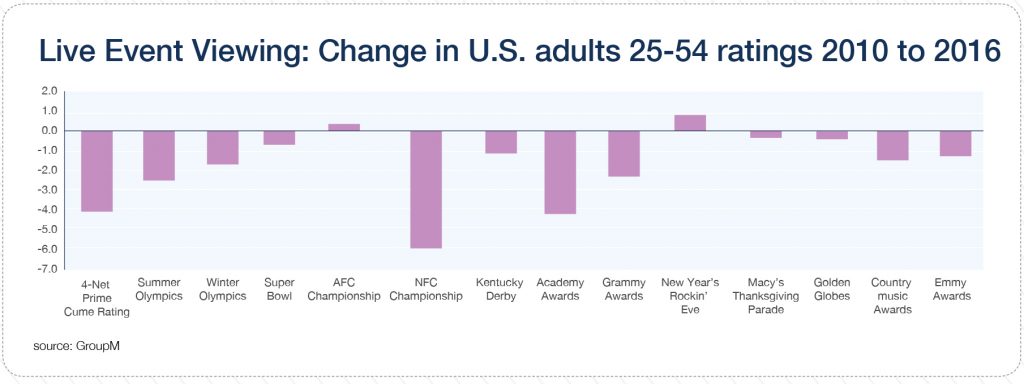

The Future Of Live Sports On TV

The number TV audiences are declining for live sporting events. There is a fundamental shift in how consumers want to engage with live sports. This is worrying for the right holders as smaller audiences mean smaller broadcast right fees. The report claims that digital is the way forward as it offers a more engaging environment and can attract new sports fans.

Sport properties and brands have already entered the digital content realm through short-form video offering behind-the-scenes access. Over the next decade, media tech platforms are likely disrupt how live sports events are consumed. The report predicts that Google will continue to explore formats on YouTube and work out how to make live sports pay in the digital ecosystem.

At present, market mix models compare multiple video streams that use different impression calculations. As a result, the viewing measurement is not fully accurate. Although the pace of change in the video marketplace continues to accelerate, measurement is still lagging behind. As audiences increasingly migrate to view content on poorly or completely unmeasured screens, this situation will only get worse. What goes unmeasured cannot be fairly or fully monetised and may not exist in the future. Going forward, the authors propose better methods to address these obstacles. The final goal is to adopt a single impression methodology that would clean up differences and enable models to produce more accurate, cross-screen allocations.